[Johannesburg] – 16 May 2023. There has been a lot of talk around the corner about PayShap – the new super-fast, low-cost payment rail which has recently launched in South Africa. It aims to foster financial inclusion and open new markets and opportunities. But before we delve deep to explore whether PayShap can increase financial inclusion, lets first understand what financial inclusion is.

Financial inclusion is defined as “the access and use of a full suite of quality financial services, at an affordable price, in a convenient manner, delivered by a range of providers in a stable and competitive market to everyone. The percentage of the population having access to such financial services denotes the percentage of financial inclusion in a country and the frequency of use of such services reflects the value it creates for consumers, also known as financial deepening”.

Financial inclusion and its effects on the wider economy are critical for achieving South Africa’s increased economic growth objective.

Can PayShap increase financial inclusion?

PayShap is a new payment rail that will enable real time movement of funds between bank accounts at a lower cost. The payment platform is designed to enable consumers to transfer funds without the need to remember or add beneficiary account details. The funds can be transferred to a unique and easy to remember proxy address (e.g., cell phone number @ bank name) which will be mapped to beneficiary’s bank account. This new payment rail will also enable the payee to request money from the payer by just entering their proxy address and upon confirmation by payer the funds will immediately reflect into payee’s account.

With the help of this new payment rail, a multitiered ecosystem can be created where the regulator, banks, and FinTechs can collaborate to do what they do best. At the core of this ecosystem, Bankserv Africa will run and administer the rail and route the payment messages. At the middle tier, banks will hold customer accounts, funds and ensure movement of funds. And at the top tier FinTechs can work their magic to provide an overlay service to enable seamless and connected customer experience. One thing to note here is that these FinTechs can only serve the banked customers (who hold an account with the banks) and can only route their transactions via these banks, which clearly indicates that unbanked customers cannot transact with PayShap.

Pricing and current design may hinder adoption.

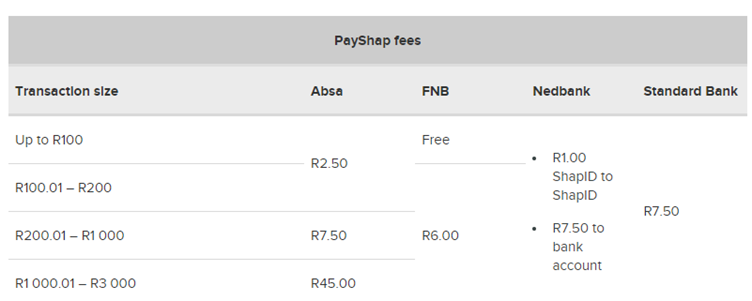

From a revenue standpoint, banks view PayShap as a payment method which could erode their card revenue rather than one that could displace cash. Because of this, the big four who have launched this payment method have maintained a relatively high fee for the customer despite of a very low participation and interchange fee. This fee is retained to recover the multi-million-rand investment that banks have made to implement PayShap. However, this high fee is counter-intuitive to adoption which eventually undermines the investment the banks and regulator have made to launch this new payment rail. Furthermore, there is no incentive for a customer to use it, why would customers stop using card when it gives them the rewards, and why would they stop using Real Time Clearing when the fee is almost the same, and how would they send the money to those who do not own a bank account? There are many whys which needs answer before one can look at a case for adoption. If we can take any inspiration from Brazil (Pix) and India (UPI), the fundamentals which can drive PayShap adoption is customer experience (with support of Fintechs) and zero fees.

Reference: Businesstech.co.za (2023) Retrieved from https://businesstech.co.za/news/banking/672429/south-africas-new-payment-system-payshap-fees-compared-nedbank-vs-absa-vs-standard-bank-vs-fnb/

A change in perspective is needed!

The reserve bank and the banks can break new ground and offset the cost of cash with PayShap, but only if it is provided free to customers. Only if PayShap is cheaper than cash and simpler than cash, it will gain widespread adoption. Its adoption can significantly reduce the usage of cash in the market thereby reducing the cost of cash i.e., costs of producing and distributing physical currency, as well as the costs of managing and protecting cash holdings. Depending on who foots the bill, the adoption can vary. And depending on scale of adoption, the value PayShap can bring to South Africa will differ.

Ends

For more information on the innovative work Synthesis has done for its clients, contact us on 087 654 3300

About Synthesis

Synthesis uses innovative technology solutions to provide businesses with a competitive edge today. Synthesis focuses on banking and financial institutions, retail, healthcare and telecommunications sectors in South Africa and other emerging markets.

In 2017 Capital Appreciation Limited, a JSE-listed Fintech company, acquired 100 percent of Synthesis. Following the acquisition, Synthesis remains an independent operating entity within the Capital Appreciation Group providing Cloud, Digital, Payments and RegTech services as well as corporate learning solutions through the Synthesis Academy.